The Month Ahead

Our regular overview highlights the key events in the markets last month and what to look out for in September.

The combination of the Olympics and the summer holiday period meant that markets were even quieter than normal, but hopes of central bank activity resulted in a steady grind higher.

Euro receives summer boost

At the end of July, at an otherwise uneventful pre-Olympics business conference in London, ECB president Mario Draghi said that the central bank would do ‘whatever it takes’ to save the euro, adding that the measures undertaken would be ‘enough’. This remarkably strong declaration boosted hopes of a remedy for the eurozone crisis, and even though the subsequent ECB meeting at the beginning of August provided little in the way of additional information, the prospect of strong action in September has been enough to keep the euro on an upward trend for the month versus the US dollar.

In the second half of the month, EUR/USD faltered at the $1.2600 level of resistance, but for now positive sentiment among investors appears to be holding up. If the next ECB meeting fails to live up to expectations, then much of this upbeat feeling might evaporate. Support would likely come in just above $1.2200 in the short term, with July's lows around $1.2000 being a longer-term possibility.

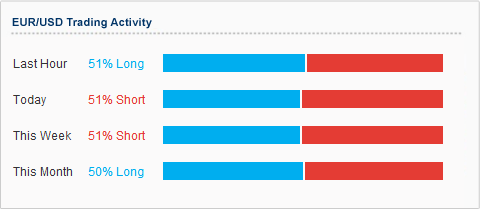

Taken from our insight, news and analysis centre, our trading activity indicator shows that clients are remarkably evenly-poised on their views on the euro. For the month as a whole, they have been positive, and the same can be said for the very short term. In the medium-term however, they are less upbeat, being short in both the daily and weekly timeframes.

Central bank hopes dominate

Looking ahead into September, all eyes are focused on the Fed and the ECB. Many still think that the Fed will launch more easing. Chairman Ben Bernanke has in the past used his annual speech at the Jackson Hole economic conference to announce new measures, and the view is that he might do so again. Meanwhile, September’s ECB meeting is fast turning into a do-or-die moment for the eurozone; with Spain and even Italy teetering on the brink of financial rescue, only a full-blown and all-encompassing programme of bond-buying is likely to be enough to satisfy financial markets.

IG Index provides an execution-only service. The material above does not contain (and should not be construed as containing) investment advice or an investment recommendation, or, an offer of or solicitation for, a transaction in any financial instrument. IG Index accepts no responsibility for any use that may be made of these comments and for any consequences that result. This communication must not be reproduced or further distributed. IG Index is authorised and regulated by the Financial Services Authority (FSA Register number 114059).

Midweek Seminar

The next midweek update online seminar by David Jones will be held at 12.30pm on Wednesday 19 September 2012.